North Carolina's Carbon Plan (CPIRP)

REACHING 70% EMISSION REDUCTIONS BY 2030

In 2021, the NC General Assembly and the Governor reached a bipartisan agreement to establish the first carbon emissions reduction goals for the electricity sector by a state in the southeast. This agreement was enacted into law as House Bill 951: Energy Solutions for North Carolina (HB 951). It requires Duke Energy to reduce carbon emissions by 70% from 2005 levels by 2030 and to achieve net-zero emissions by 2050. To reach these statutory requirements, the law directs the NC Utilities Commission (Commission) to develop a plan, otherwise known as the ‘Carbon Plan,’ and to update that plan every two years. The carbon reduction goals can be achieved using technologies such as power generation, transmission and distribution, grid modernization, storage and energy efficiency measures, demand-side management, and the latest technological breakthroughs that meet the least-cost criteria and transitioning away from burning coal and gas for energy.

Quickly access information on each of the following

Stay up to date with information on the Carbon Plan:

House Bill 951

House Bill 951 Energy Solutions for North Carolina (HB951) became law in October 2021, marking North Carolina’s largest energy policy milestone since the 2017 enactment of House Bill 589 (HB589). Like HB589, Energy Solutions for North Carolina first emerged from a House-led stakeholder process that took place over months. The bill underwent several iterations in the House before the Senate made further changes to the bill, which largely were the result of negotiations between Senate leadership and the Governor’s office. NCSEA worked with lawmakers and fellow stakeholders from the beginning of the process through the final passage of HB951.

This comprehensive bill covered many aspects of the energy industry, including regulatory reform, solar decommissioning, competitive procurement, and coal retirement. However, the most notable provision requires the NC Utilities Commission to take “all reasonable steps” to achieve 70 percent carbons emissions reductions from 2005 levels by 2030 and to achieve carbon neutrality by 2050, codifying the carbon reduction goals outlined in North Carolina’s Clean Energy Plan (Part I Section 1 of HB951). The NCUC is also required to develop, with input from stakeholders and utilities, a Carbon Plan to meet these emission reduction requirements using a least-cost approach. The first Carbon Plan order was issued in December 2022 and will be revisited every two years. A full synopsis of the bill can be found on NCSEA’s HB951 webpage here.

North Carolina Carbon Plan/Integrated Resource Planning Proceeding (CPIRP) (2024)

Background

As part of the NC Utilities Commission’s 2022 Carbon Plan order, the Commission set the stage for future Carbon Plan updates by outlining a new combined proceeding called the Carbon Plan and Integrated Resource Planning (CPIRP). Previously, North Carolina utilities were required to file an updated Integrated Resource Plan (IRP) every two years, outlining the utility’s proposal to match future supply and demand. Now, with these combined proceedings, the CPIRP will serve as both a plan to meet statutory carbon emissions reduction requirements and an IRP.

Similar to the initial Carbon Plan proceeding, the Commission preserved the process of Duke as the first mover with the opportunity to rebut intervenors’ analyses and expert testimonies. However, this time around intervenors had 180 days to respond to Duke’s plan versus the previous 60 days.

With requirements to update the Carbon Plan every two years, the 2024 CPIRP order is due by December 31, 2024. In order to meet that deadline, the NCUC ordered the following procedural schedule:

- September 1, 2023 – Deadline for Duke Energy’s Initial CPIRP Proposal and Direct Testimonies

- May 28, 2024 – Deadline for Intervenors to Review and Respond to Duke’s Plan

- July 1, 2024 - Deadline for Duke to file rebuttal testimony and exhibits of expert witnesses

- July 22, 2024 - Expert witness hearing to review CPIRP intervenor testimonies and proposals begins

- December 31, 2024 – CPIRP order from the Commission due

Read the NCUC Order: NCUC's 2022 Carbon Plan order outlining CPIRP process

Duke Energy’s Proposal & Supplemental Filings

Duke filed a proposed combined Carbon Plan and IRP (CPIRP) in August 2023 and associated expert testimony in September 2023. Overall, Duke Energy’s proposed plan presents multiple portfolios depicting the future of electricity generation in our state. Notably, only one of Duke’s proposed portfolios would achieve the HB 951 requirement of reducing carbon emissions by 70% from 2005 levels by 2030 and it is not the preferred portfolio that Duke recommends.

Table 1: Proposed Resource Additions for Duke Energy’s Original 2024 CPIRP Proposal

The table above outlines Duke Energy’s original CPIRP proposal with all scenarios heavily relying on combined cycle and combustion turbine natural gas generation with artificial limitations placed on solar, storage, and wind assets. This proposal, though, only outlines the original filing made in August 2023 by Duke Energy.

To the surprise of many intervenors, the utility came back to the Commission in November 2023 with the request to update their modeling due to unforeseen new load demand on the grid. According to the utility, “energy use by Duke Energy customers in the Carolinas is projected to grow by around 35,000 gigawatt-hours over the next 15 years – more than the annual electric generation of Delaware, Maine and New Hampshire combined.” To further contextualize, Duke also states that this “estimated peak load growth by 2030 is eight times the growth projected just two years ago.”

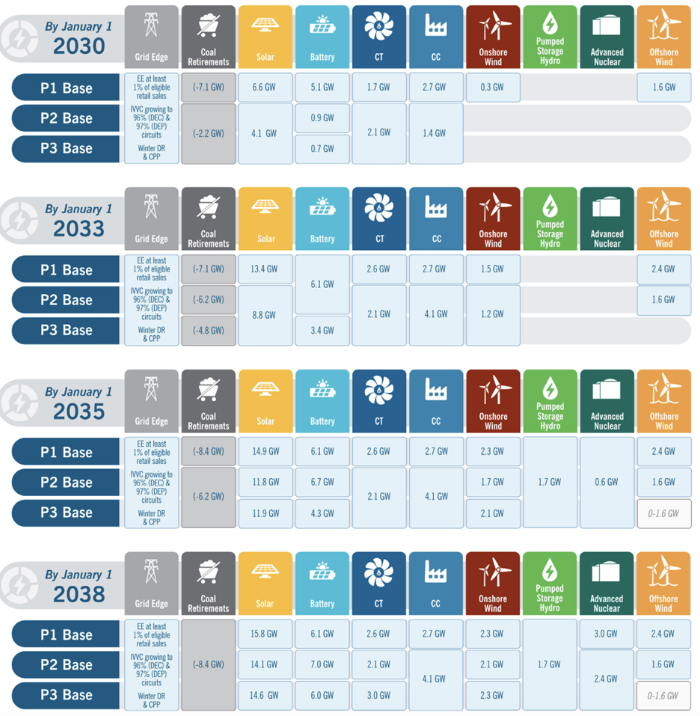

To meet that increased demand, Duke’s supplemental filing (abbreviated in this fact sheet) outlines a preferred scenario that does not comply with the statutorily required carbon reduction mandate until 2035, five years after the HB 951 deadline. Duke’s preferred scenario also proposes 8,925MW of new combined cycle and combustion turbine natural gas facilities, only 6,460MW of new solar, 2,700MW of new storage, and 2,400MW of new offshore wind. The proposed resource additions and timeline for those additions can be found in the chart below.

Table 2: Duke Energy’s Preferred Carbon Plan Scenario (Supplemental Filing)

Intervenors Respond

NCSEA’s Filing and Testimony on Long-Lead Resources

NCSEA retained experts Dr. John O’Brien and Philip Moor to challenge the technical and economic assumptions made by Duke Energy in their preferred Carbon Plan scenarios related to long-lead generation resources like offshore wind and small modular nuclear (SMR) facilities. In particular, NCSEA’s experts disagree with Duke’s request for authorization to solely incur costs for early development activities associated with SMRs, but not for offshore wind—even after accelerating offshore wind’s deployment in Duke’s supplement filing. Prudent planning should require that offshore wind receive equal treatment to also incur similar development costs.

Specifically, Duke requests an additional $365 million in early SMR development costs (on top of the $75 million authorized by the Commission in the 2022 Carbon Plan), while deferring early development activities for offshore wind with only a request for $1.4 million associated with an Acquisition Request for Information (ARFI) to further study offshore wind.

NCSEA and its experts believe that prudent planning requires an embrace of generation diversity to assure adequate resources are available for Duke to reliably serve its customers. NCSEA’s experts’ report recommends that the Commission authorize the offshore wind area leaseholders in North Carolina to incur early development costs that are in line with the existing $75 million already authorized for early development costs associated with SMRs.

Additionally, NCSEA’s experts’ report recommends that investing in a diversity of resources like offshore wind hedges against future risk should planned technologies like SMRs not come to fruition. This is incredibly important in a high-load growth scenario to meet future demand and maintain reliability. Importantly, NCSEA’s testimony outlines the following recommendations as it relates to offshore wind:

- Adopt a procedural schedule requiring interim updates from Duke and the wind energy area leaseholders of the Acquisition Request for Information (ARFI) process and its preliminary results in the Fall of 2024. This proposed process will expedite the ARFI process to help accelerate offshore wind deployment and ensure developers can adequately maximize all Inflation Reduction Act incentives.

- Direct Duke and leaseholders to jointly develop procurement schedules for each wind energy area, with achievable milestones through 2032, to achieve, at a minimum, the proposed 2.4 GW of offshore wind generation outlined in Duke’s supplemental filing.

- Authorize early development activities for deployment of offshore wind with approximately $75 million in funding – equivalent to new nuclear resources through 2026. Authorizing these costs will further provide the Commission with more accurate and detailed projected cost estimates needed to assess offshore wind.

- Following the conclusion of the ARFI, convene a separate docket specifically for the purpose of receiving annual updates to track offshore wind procurement and development activities.

In summary, NCSEA believes, based on expert advice, that the Commission in the CPIRP proceeding should authorize adequate early development costs for offshore wind, similar to what has already been approved for new nuclear resources. We also recommend that the Commission order an expedited ARFI process to meet deployment targets, serve long-term reliability needs, provide Duke customers cost-savings, while assuring continued investments by offshore wind developers in North Carolina. At the same time, it is also imperative that the Commission establish a formal proceeding for tracking offshore wind development efforts to ensure we’re on target for deployment timelines.

All of these measures are critical to establishing a viable offshore wind future in the state as we look to diversify generation resources, maintain reliability, and preserve low costs for residential and commercial ratepayers.

Filing: NCSEA Testimony on Long-Lead Resources

Joint Filings on Behalf of the Southern Environmental Law Center, NCSEA, Southern Alliance for Clean Energy, Sierra Club, and the Natural Resources Defense Council

Additionally, NCSEA and the Southern Environmental Law Center, on behalf of the Natural Resources Defense Council, Sierra Club, and the Southern Alliance for Clean Energy, jointly submitted testimony in the 2024 CPIRP proceedings challenging many of Duke’s assumptions. These challenges were elevated in the expert testimonies presented by Maria Roumpani, Michael Goggin, Jim Wilson, and Jake Duncan.

All in all, these experts outlined the greater concern that Duke’s proposed plans do not comply with HB951 and heavily rely on new gas assets in every pathway considered. There are also significant concerns that Duke’s plans for delayed coal retirement and new natural gas plants will not comply with the new power plant rules recently announced by the US Environmental Protection Agency. On the renewables side, this group of intervenors jointly expresses their concerns that Duke’s modeling again places artificial limits on the amount of new solar and storage deployed, especially in a high load growth environment.

Jointly, the coalition has proposed a variety of recommendations and solutions to ensure long-term grid reliability and mitigate against the risk of continued rate increases, including:

- All-of-the-Above - Requiring the review of alternatives that Duke did not sufficiently explore when proposing its significant fossil fuel generation build-out in its CPIRP filings. Duke’s preferred pathway and portfolio solves a transient need by heavily relying on gas combined cycle and combustion turbine generators, but these long-lived assets are likely to become stranded with Duke customers covering their costs for decades while other assets are not being maximized. Accordingly, the Commission should not approve Duke’s preferred pathway and portfolios as they are not representative of a “diverse all-of-the-above resource portfolio.”

- Red Zone Expansion Projects - Approving the additional, proposed Red Zone Expansion Projects while also fully embracing proactive multi-value transmission planning to identify upgrades that not only allow the interconnection of additional renewable resources, but also maximizes reliability, cost-effectiveness, and other transmission benefits to pass through larger net benefits to Duke Customers.

- Interconnection - Increasing, or eliminating, the limits on solar and battery interconnection as they artificially constrain the contributions of cost-effective renewable and storage resources while other solutions to Duke’s interconnection challenges exist.

- Transmission Interconnects - Requiring Duke to plan stronger transmission ties with neighboring utilities, including the merger of Duke Energy Progress and Duke Energy Carolinas, to increase reliability, reduce planning reserve margins, and cost-effectively meeting future needs and carbon reduction requirements.

- Large Customers - Developing a new customer class for customers with energy needs 20 MWs or greater and pathways for this class of customers to serve their energy needs (i.e., self-generation or firm power purchase agreements) while appropriately sharing the costs for system upgrades these large customers are triggering.

- Load Forecast - Directing the Duke to engage professional load forecasters to perform a study with multiple longer-term scenarios about future load increases caused by large customers with energy needs 20 MWs or greater.

- Distributed Resources - Requiring Duke to engage with stakeholders to appropriately analyze and model distributed energy resources (including behind-the-meter storage and electric vehicles) and aggregated distributed energy resources (including Virtual Power Plants with a goal of 300 MW by 2030) in Duke’s long-term resource planning.

- Distribution Plans - Requiring Duke to develop Distribution Resource Plans as part of future CPIRP proceedings.

September 2024 Carbon Plan News:

September 3, 2024, was the deadline by which intervenors in the Carbon Plan/Integrated Resource Plan docket could file post-hearing briefs and proposed orders for the NC Utilities Commission to consider. The Commission is expected to issue an order in this docket by or before December 31, 2024. The post-hearing briefs summarize and highlight expert testimonies provided to the Commission and make specific recommendations for actions to the Commission. Proposed orders provide language that intervenors want the Commission to adopt in the final order.

NCSEA filed three documents on September 3; they are linked below:

- E-100 Sub 190 SACE, et al., and NCSEA Joint Post-Hearing Brief and Joint Partial Proposed Order - PUBLIC: NCSEA, along with Southern Environmental Law Center’s clients, Southern Alliance for Clean Energy (SACE), Sierra Club, and Natural Resources Defense Council (NRDC), filed a comprehensive post-hearing brief and joint proposed order summarizing testimonies presented to the Commission in support of requiring Duke Energy to meet the 2030 carbon emissions reduction deadline and investing in more clean energy. The brief covers many issues – too many to summarize here - so please take a look!

- E-100 Sub 190 Post-Hearing Brief of NCSEA in Support of Agreement and Stipulation of Partial Settlement: NCSEA’s post-hearing brief on a proposed partial settlement on large customer programs, demand side management, and reserve margin that NCSEA proposed with Carolina Industrial Group for Fair Utility Rates (CIGFUR), Carolina Utility Customers Association (CUCA) and Clean Energy Buyers Association (CEBA).

- E-100 Sub 190 Partial Proposed Order of CIGFUR, CUCA, CEBA, and NCSEA: This proposed order offers language that the Commission may adopt to advance large customer programs, demand side management, and to keep the current resource reserve margin in place at 17% instead of raising it to 22% as Duke Energy proposed.

North Carolina Carbon Plan Proceeding (2022)

Background and Procedural

Shortly after the NC General Assembly passed HB951, the NC Utilities Commission (NCUC) opened a proceeding to develop the first iteration of a plan designed to lower carbon emissions in the electricity sector by 70% over 2005 levels by 2030 and to achieve carbon neutrality by 2050. On November 19, 2021, the NCUC issued a procedural order establishing the roles of interested and affected parties and the timeline for developing a plan. This order outlined the NCUC’s mandate to establish a finalized initial ‘Carbon Plan’ under an accelerated timeframe by December 31, 2022. From there, Duke Energy was directed to file the first proposed Carbon Plan by April 1, 2022, with intervenors having 60 days to review and respond to the proposed Duke plan. Duke was also directed to conduct three stakeholder meetings to gather feedback on their proposal. Additionally, the Commission later ordered that five public hearings be conducted across the state to directly gather input from the rate-paying public. On December 30, 2022, the NCUC Issued a Carbon Plan Order

Read all filings and orders in the first Carbon Plan proceeding.

Duke Energy’s Proposal

To create its Carbon Plan, the NCUC directed Duke Energy (‘Duke’) to file a proposed Carbon Plan after conducting at least three stakeholder convenings with a broad coalition of interested parties. The initial plan from Duke was due to the NCUC by May 16, 2022, with the Commission’s final Carbon Plan due by December 2022.

In accordance with the May 16 deadline, Duke did file its proposed plan, though with very little insight ahead of time as to what it may contain. NCSEA, our partners, and many others raised concerns throughout the stakeholder processes about a lack of transparency by the utility, creating an almost black-box type scenario that would catch many by surprise once the final plan was filed. While Duke had more than eight months to prepare their plan, NCSEA and partners had less than 60 days to digest the nearly 900-page document, provide feedback, and conduct their own modeling in response.

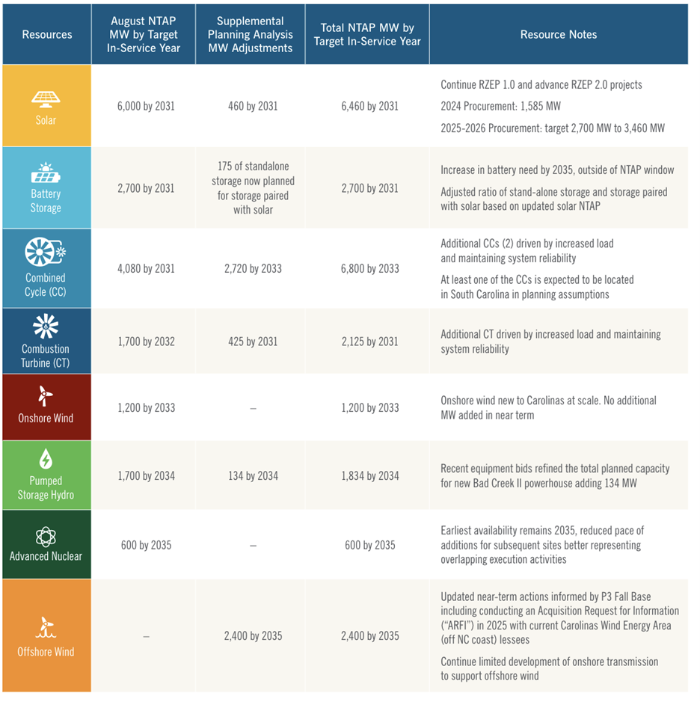

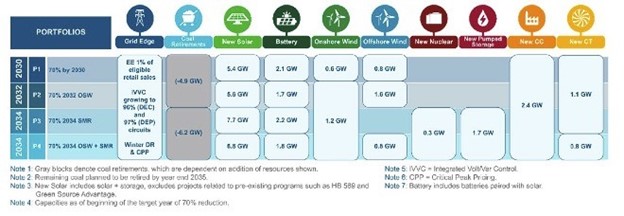

Overall, the proposed plan presents four scenarios depicting the future of electricity generation in our state, as seen in Figure 1. Notably, only Portfolio 1 achieves the HB 951 requirements of reducing carbon emissions 70% by 2030.

Figure 1: Annual CO2 emissions by Portfolio, Combined Carolinas’ System (millions of short tons) [Credit: Duke Energy’s Carbon Plan, Ch. 3: Portfolios, p.26]

To further illustrate the details of each of these scenarios, Figure 2 below outlines the generation resources proposed by Duke under each of the four scenarios. As demonstrated in the figure below, Duke proposed significant dependence on new natural gas generation with more than 4GW of new capacity. Additionally, these scenarios slow roll the deployment of new solar and storage assets, while outlining plans for new small modular nuclear reactors.

Figure 2: Portfolio Snapshot to Achieve 70% Interim Target (2030-2034) [Credit: Duke Energy’s Carbon Plan, Ch. 3: Portfolios, p.3]

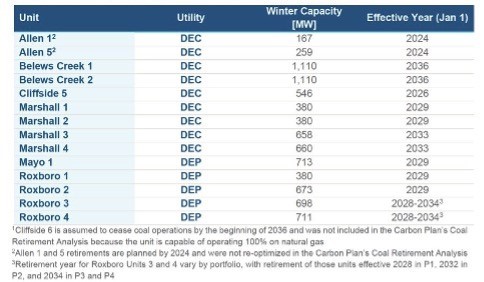

Aside from new resource additions, Duke also proposed delaying the retirement of existing coal-fired power plants across the state. In Figure 3 below, the utility is planning to operate Marshall 3 and 4 through 2033 and Belews Creek 1 and 2 through 2036. It is no surprise that three-quarters of Duke’s proposed portfolios fail to meet the HB 951 2030 requirement when considering the reliance on high-emitting energy sources well into the next decade.

Figure 3: Coal Unit Retirements (effective Jan 1 of year shown) [Credit: Duke Energy’s Carbon Plan, Ch. 3: Portfolios, p.7]

Intervenors Respond

After Duke Energy filed their proposed scenarios on May 16, 2022, clean energy advocates were given 60 days to digest the nearly 900-page document and prepare alternative lower-cost, lower-carbon plans. On July 20, 2022, the North Carolina Sustainable Energy Association, the Southern Environmental Law Center, the Natural Resources Defense Council, the Southern Alliance for Clean Energy, and the Sierra Club jointly filed comments and carbon plan modeling to the Commission. The modeling and analysis filed at the Commission was conducted by Synapse Economics Inc., RMI, and Grid Strategies LLC.

The modeling conducted by Synapse using Encompass outlined three scenarios for comparison's sake:

- Duke Resources: Provides a baseline for comparison. This scenario mimics the P1-Alternate scenario proposed in Duke’s carbon plan but uses a revised set of modeling inputs. Note, EnCompass performed a sensitivity to assess the impact of a Regional Greenhouse Gas Initiative (RGGI) on carbon emissions and found that RGGI would cause emission reductions of hundreds of thousands of tons per year in the coming decades, allowing this scenario to meet HB 951 mandates by 2030;

- Optimized: Utilizes Encompass’ economic optimization algorithm to select an economically optimal portfolio of resources, using revised model inputs and making more zero carbon resources available-energy efficiency, renewables, and battery storage; and

- Regional Resources: Allows software to select Midwest wind resources via power purchase agreements through PJM Interconnection.

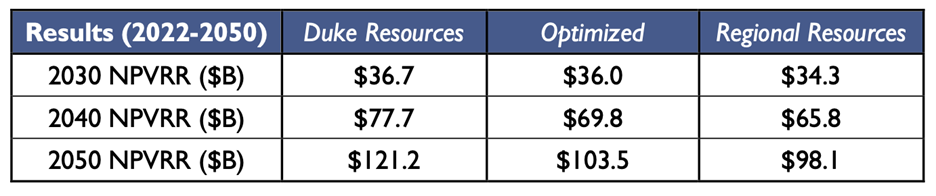

The results of the modeling were fairly straightforward in nature, demonstrating that additional renewable resources would drive down costs for ratepayers, maintain reliability, and accelerate carbon emissions reductions. Table 1 below demonstrates the cost savings of the intervenors’ modeling:

Table 1: Net Present Value Revenue Requirements (NPVRR) over Time by Scenario (Source: Synapse Report pg. 2)

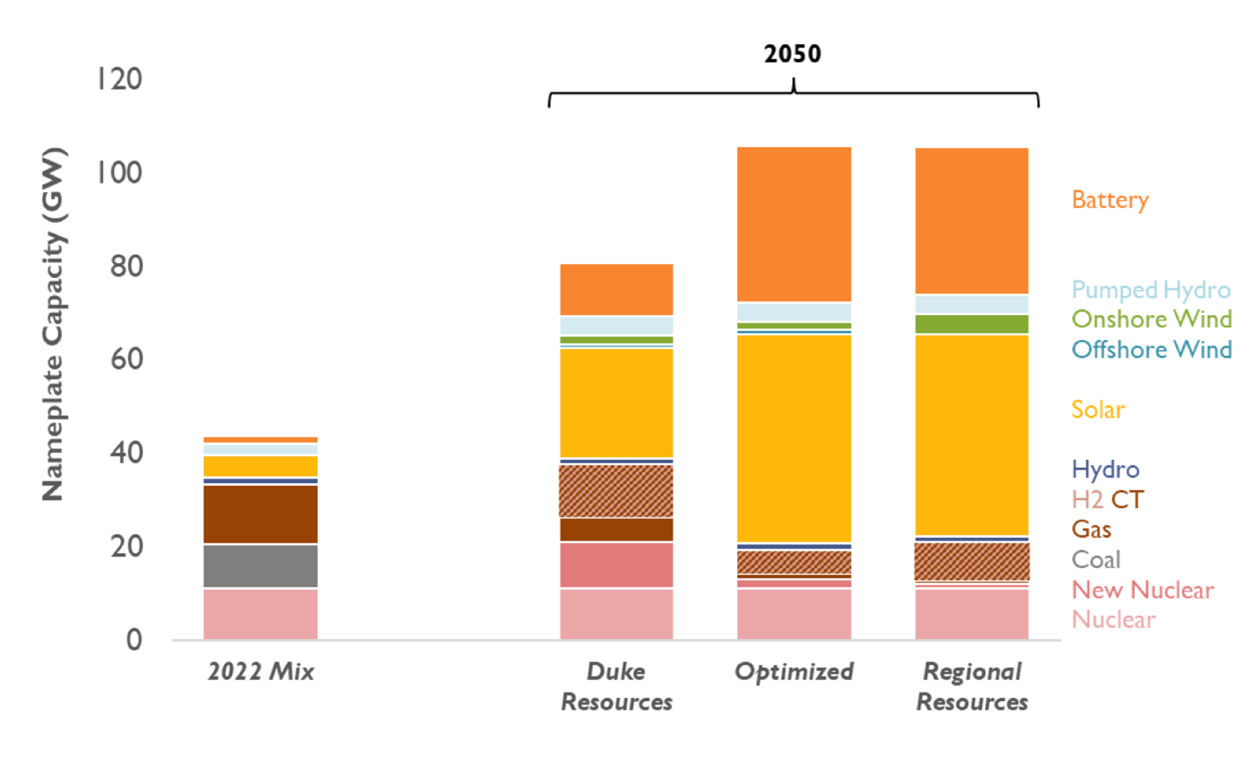

To help further explain the cost savings that could be achieved under the intervenors’ modeling, Figure 4 below outlines the proposed capacity additions as compared to Duke’s modeling.

Figure 4: Capacity by Resource Type, 2022 and 2050 by Scenario (Source: Synapse Report pg. 2)

The Synapse modeling demonstrates that the path to meeting North Carolina’s emissions reduction requirements is rooted in larger investments in existing clean technology. It is also clear that supporting widespread clean energy deployment calls for sufficient grid planning and infrastructure buildout.

The CLEAN intervenors’ carbon plan layers in key levers like securitization and price-based ratemaking, constructing better energy systems and saving North Carolinians more money on their energy bills.

On top of addressing the shortcomings of Duke’s proposed carbon plan, the CLEAN Intervenors’ modeling exhibits the following advantages across its scenarios:

- Cost savings: 2-7% by 2030 and 15-19% by 2050, compared to Duke Resources scenario. This includes NPVRR savings growing from $700 million-$2.4 billion and $17.7-$23.1 billion from 2030 to 2050, respectively;

- No new proposed natural gas: The Synapse scenarios do not select any additional buildout of combined-cycle (CC) or combustion turbine (CT) gas units in its portfolios. There is also less reliance on unproven, uncertain technologies like SMRs and zero-carbon hydrogen availability;

- Increased deployment of proven, scalable renewable energy: Significantly more solar, storage, and wind exist at the core of the Optimized scenario. This portfolio consists of 7.2 GW of solar and 5.6 GW of storage by 2030. By 2040, these figures grow to 22.5 GW of solar, 800 megawatts (MW) of offshore wind, 1.5 GW of onshore wind, and 17 GW of energy storage resources compared to today;

- Earlier retirements of coal and gas: By relying more on cleaner sources of electricity generation, 3.5 GW of coal capacity can be economically retired earlier than in Duke Resources proposal. Furthermore, in the final years of the Synapse planning period, between 800 and 1,300 MW of existing gas resources are economically retired, resulting in the avoidance of expensive utility retrofits to be able to burn hydrogen;

- Energy efficiency easing of grid pressure: The Synapse scenarios include energy efficiency savings of 1.5% of total retail load. Energy efficiency is an achievable, cost-effective pathway for the Duke Energy system to require 2% less energy by 2035 and 5% less energy by 2050, compared to the utility’s baseline assumptions. Energy efficiency alone would save ratepayers in North Carolina billions of dollars by 2050; and

- Collaborative regional purchase agreements: One of the additional scenarios proposed by the CLEAN Intervenors, Regional Resources, underlines the promise of regional coordination and transmission capabilities to provide cost-effective power to North Carolina. This particular portfolio utilizes onshore wind power purchases from the Midwest, allowing the system to procure cost-effective electricity and save ratepayers $1.7 billion by 2030 and $5.4 billion by 2050.

Commission Order

The North Carolina Utilities Commission issued its first Carbon Plan order on December 30, 2022, after more than a year of proceedings. The Carbon Plan ordered by the NCUC on December 30 endorsed Duke’s proposed near-term action plan, with one exception: delaying a decision on an offshore wind lease area to pursue. The Commission left the door open for the buildout of new gas, hydrogen, and SMR facilities. And though no single portfolio was selected from the four scenarios that Duke presented (three of which failed to meet the 2030 deadline for 70% emissions reduction), NCSEA and our partners believe there is significant room for improvement.

Clean energy and consumer advocates hoped for a larger focus on energy efficiency and renewables like solar, battery storage, and wind moving forward. With an increasing amount of data showing that renewable energy is a more cost-effective form of electricity generation than fossil fuels, it’s clear that our state is ready for a wide-scale transition to low-carbon sources. This is especially true considering the expansion and extension of federal tax incentives, particularly the Investment (ITCs) and Production Tax Credits (PTCs), found in the $370 billion Inflation Reduction Act.

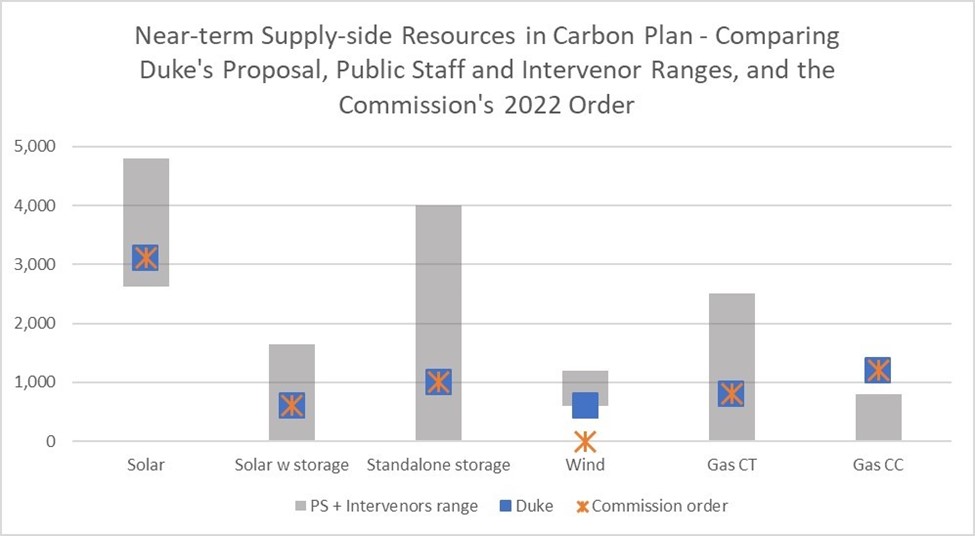

Figure 5 below, created by the Southern Alliance for Clean Energy, compares some of the supply-side resource selections in the Commission’s Carbon Plan with the proposals of both Duke and other intervening parties, including the NCUC Public Staff.

Figure 5: Comparing Supply-side Resources of the Carbon Plan with Other Proposals

Of note, the NC Utilities Commission’s Carbon Plan order included the following:

- Coal-fired power plant retirements: The order accepted Duke’s proposed retirement schedule for 8,400-megawatts (MW) of its coal-fired power plants by 2035, with some remaining in operation as late as 2035, as “reasonable for planning purposes.” On top of the unnecessary pollution and carbon emissions created by this prolonged retirement schedule, ratepayers would also bear the risks associated with volatile fuel costs and keeping old, uneconomic coal plants running. On the other hand, earlier coal retirements like proposed in our modeling would avoid expensive utility retrofits, and lead to additional savings associated with securitization, a way of refinancing a portion of the outstanding balance of coal plants that are retired ahead of schedule.

- Natural gas, hydrogen, and nuclear energy: The Commission approved for planning purposes 800 MW of combustion turbine and 1,200 MW of combined cycle gas generation capacity. It also upheld using a 35-year operational life assumption for these new gas plants, with an assumption that green hydrogen fuel will replace gas to offset carbon emissions. It is yet to be determined if this assumption is technologically or financially feasible.

We, along with other parties who conducted modeling, challenged the 35-year operational life assumption of a power plant. It’s important to note that continuing to operate gas plants for that long in the event that hydrogen is not a viable option would violate the law’s net-zero by 2050 requirement. The order also determined that Duke may pursue unproven SMR nuclear technology, allowing Duke to spend up to $75 million of ratepayer money in the near term for permitting and development of this speculative technology.

- Renewables:

-

- The Carbon Plan order outlined renewable energy capacity additions that includes 1200 MW of solar procured through the 2022 competitive procurement for renewable energy RFP process (which includes 441 MW that Duke was supposed to procure in 2021 under previous state law), and an additional 2350 MW to be procured in 2023 and 2024.

- Storage: The Carbon Plan states that 1000 MW of standalone battery storage and 600 MW of solar plus storage shall be procured between 2023 to 2024.

- Offshore Wind: The commission ordered an offshore wind study to be conducted by Duke Energy to consider each of the three wind energy areas off the coast of North Carolina, one of which is owned by one of Duke’s unregulated affiliates. The Commission directed that the utility's study of these lease areas remain unbiased despite Duke Energy Renewables Wind’s ownership of the Carolina Long Bay lease and Duke’s prior argument that it should be allowed to move forward with its affiliate’s lease area.

- Onshore Wind: Duke was ordered to conduct stakeholder engagement sessions to determine viability of onshore wind as soon as practicable and to incorporate those findings into the next iteration of the Carbon Plan.

- Pumped Storage Hydropower: NCUC gave its nod of approval to the proposed Bad Creek pumped storage hydro facility expansion, allowing Duke to spend up to $40 million to add 1700 MW of capacity—effectively doubling this resource’s capabilities.

- Energy efficiency and demand-side management: The Commission approved Duke’s target of 1% eligible load reduction per year for planning purposes, though required the modeling of a 1.5% aspirational efficiency savings goal as part of the next Carbon Plan.

- Proactive transmission planning: 14 red-zone transmission upgrade projects were approved by the Commission. These red-zone areas are locations in need of significant upgrades to interconnect additional solar across the grid in North Carolina. In fact, these upgrades would enable an additional 3000 MW of solar interconnection. These projects will still need approval from the North Carolina Transmission Planning Collaborative. In addition, the Commission “strongly advised” Duke to look for ways to improve the local transmission planning process and quickly implement any improvements that FERC may require in a final rule resulting from its recent regional transmission planning proposed rulemaking.

- Justice & Equity: The Commission directed Duke to develop targeted engagement plans for impacted communities, enact these plans in the near term, and report on progress and the ensuing engagements with stakeholders in the upcoming combined proceedings.

A Full Summary of the NCUC 2022 Carbon Plan Order

SACE Analysis of NCUC 2022 Carbon Plan Order

NCUC 2022 Carbon Plan Order