Response to Duke Energy’s Proposed Combined Carbon Plan and Integrated Resources Plan (CPIRP)

Background on the Carbon Plan

In 2021, leadership in the North Carolina General Assembly and the Governor reached a bipartisan agreement to establish the first carbon reduction mandates for a state in the Southeast. This agreement was enacted into law as House Bill 951: Energy Solutions for North Carolina (HB 951). It requires Duke Energy (Duke) to reduce carbon emissions 70% from 2005 levels by 2030 and to achieve net-zero emissions by 2050. To reach these goals, the legislation directed the North Carolina Utilities Commission (Commission) to develop a plan (otherwise known as the ‘Carbon Plan’) to meet the emissions reduction mandates within the legislatively mandated timeframe.

In creating the first iteration of the Carbon Plan, the Commission directed Duke to file a proposal after conducting a series of stakeholder meetings. NCSEA responded with this analysis. Intervening parties had 60 days to respond to Duke’s proposal and file their modeling (see here for a synopsis of NCSEA and our partners’ proposed model). After weeks of hearings, the Commission issued its first Carbon Plan order in December 2022. NCSEA’s response is here. While the Carbon Plan authorized new generation capacity additions for planning purposes, each addition still requires a Certificate of Public Convenience and Necessity (CPCN) from the Commission. The Commission is expected to consider two CPCNs for new gas plants in 2024.

As part of the 2022 Carbon Plan order, the Commission directed that the plan be updated every two years in combination with the existing Integrated Resource Plan (IRP) process. The IRP is an ongoing process that the Commission uses for long-term utility generation planning in the state.

Shortly after the first Carbon Plan was authorized, the process for updating the plan was already underway. Here’s the timeline for the Carbon Plan/Integrated Resources Plan (CPIRP) update:

- September 1, 2023 – Duke filed its proposed biennial CPIRP and testimony.

- February 28, 2024 – Deadline for intervenors, such as NCSEA, to file testimony and exhibits commenting on or providing an alternative to Duke’s proposal.

- April 15, 2024 – Duke shall file its rebuttal testimony.

- May 14, 2024 – Commission will hold an expert witness hearing in Raleigh. The hearing may last days or weeks.

- December 31, 2024 – CPIRP order from the Commission due.

Carbon Plan 2.0 and Initial Analysis

As part of the first steps in updating the Carbon Plan, Duke filed a proposed combined Carbon Plan and IRP (CPIRP) in August 2023 and associated expert testimony in September 2023.

NCSEA and our partners have been digesting the proposal and conducting modeling to bring before the Commission in support of more near-term clean energy deployment to meet the carbon emissions reduction requirements set in law by HB 951.

Overall, Duke Energy’s proposed plan presents multiple portfolios depicting the future of electricity generation in our state. Notably, only one of Duke’s proposed portfolios would achieve the HB 951 requirement of reducing carbon emissions by 70% from 2005 levels by 2030 and it is not the preferred portfolio that Duke recommends.

This is a major cause for concern, as Cassie Gavin, NCSEA’s Director of Policy, explained: “While the law allows the Commission flexibility on the compliance deadline for certain reasons, NCSEA believes that Duke Energy should strive to meet the 2030 goal in the most affordable way possible. The modeling conducted by the CLEAN Intervenors (NCSEA, Southern Environmental Law Center, Sierra Club, Southern Alliance for Clean Energy, and Natural Resources Defense Council) in 2022 showed that the least cost pathway to reach the emissions reductions required by law is more near-term deployment of renewables like solar and storage. Additionally, our modeling showed that North Carolina doesn’t need new fossil-fuel plants that may end up becoming stranded assets customers end up paying for long after their useful life.”

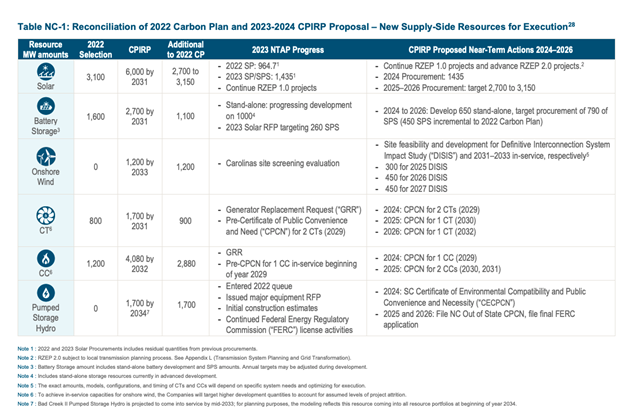

Source: Duke Energy’s 2024 CPIRP Proposal

Duke Energy’s Proposed Generation Sources

Natural Gas: A major concern of NCSEA and our partners is Duke’s proposal for significantly more new natural gas resources in the company’s preferred plan than Duke proposed in 2022.

In 2022, Duke proposed an 800 MW gas combustion turbine and 1,200 MW of combined cycle gas generation. Now, Duke is proposing 1,700 MW of combustion turbine generation and 4,080 MW of combined cycle gas generation by 2032. Further, Duke relies on a speculative approach that the company will be able to convert its proposed gas plants to use hydrogen and that there will be plentiful clean hydrogen available for full conversion. If Duke converts gas plants to be able to use hydrogen but the hydrogen is created by the burning of fossil fuels, then the potential emissions benefits are questionable. All in all, there are a lot of question marks about the commercial viability of hydrogen technology and availability, factored on top of the large potential costs to ratepayers in converting natural gas facilities and infrastructure to use hydrogen.

Additionally, NCSEA is concerned that building new, capital-intensive centralized generation resources could walk us down the same path as coal generation, resulting in stranded assets that later are forced into early retirement, which would mean putting unnecessary costs on customers.

Solar Energy: Solar is the region’s most cost-effective and readily scalable resource, so NCSEA supports bold investments in solar and solar plus storage in the near term to meet the 2030 goal. The 2022 Carbon Plan order directed Duke to procure 2,350 MW of new solar in addition to the solar procured in the 2022 solar procurement program equaling 3,100 MW of solar targeted for 2022-2024. This was less than NCSEA and our partners proposed. Duke proposes in the 2023 CPIRP to procure 1,435 MW of new solar and solar plus storage in 2024 and between 2,700 MW and 3,150 MW of new solar and solar plus storage in 2025 and 2026. Duke proposes more solar for post-2027 than the initial Carbon Plan but still not as much as NCSEA and our partners proposed in 2022. Prioritizing early investments in solar would avoid delays in execution and potentially higher costs due to inflation. Note that solar is also an important asset from a reliability perspective, as the resource performed as expected during Winter Storm Elliott in 2022.

Wind Energy: Offshore wind has proven itself as a dependable technology with 42 megawatts of turbines deployed off the coast in United States federal waters. Wind energy pairs well with solar due to maximum resource outputs at different times of the day. North Carolina has the second-highest offshore wind net technical energy potential in the U.S. according to the National Renewable Energy Laboratory and an estimated 4 GW of capacity leased through the past two auctions according to Duke’s proposed CPIRP Appendix I “Renewables and Energy Storage”. The potential of the resource is starting to come to fruition here in the state with projects in planning and development off the coast, including the Kitty Hawk and Wilmington East wind energy areas. Duke itself secured an offshore wind lease in May 2022. Yet, offshore wind is not included in Duke’s preferred portfolio except that the company would like to “preserve the option of 1,600 MW offshore for 2033 or later.” Duke does not select offshore wind in its recommended Core Portfolio P3 Base through the end of the base planning period by 2038 but offshore wind is selected beyond the base planning period. Duke does not propose to obtain a lease and proceed with initial offshore wind development activities that would make offshore wind available in the Carolinas in the early 2030s. However, the company says it is monitoring and evaluating the offshore wind option for energy needs in the mid-2030s.

Duke proposes new onshore wind plans in the CPIRP and asks for the Commission to authorize project development costs up to $64.5 million for the development of three annual tranches of onshore wind through 2026 for purposes of achieving 1,200 MW in service by 2033.

Energy Storage: Duke proposes 650 MW of standalone battery storage to be procured in 2025-2026 for operation by 2031. This is in addition to the previously Commission-directed 1,000 MW of standalone battery storage in the 2023-2024 timeline. Investments in energy storage are instrumental to grid reliability in the state by adding more firm, dispatchable resources during times of need, such as during 2023’s Winter Storm Elliott.

Energy Efficiency/Demand-Side Management: In the initial Carbon Plan, the Commission found that Duke Energy’s assumption that it can achieve a 1% reduction in eligible retail load (load attributable to retail customers minus the portion of nonresidential customers who opt out) through energy efficiency/demand-side management measures was reasonable and that Duke should seek an aspirational goal of 1.5%. NCSEA and our partners argued that ordering Duke to achieve a 1.5% reduction of all retail sales (load attributable to residential and nonresidential customers) would result in lower costs and other benefits to Duke ratepayers. Our modeling showed that energy efficiency savings could lead to 2% less energy required across the Duke system by 2035 and 5% less by 2050 as compared to Duke’s baseline assumptions. NCSEA would like to see the Commission order an increased energy efficiency goal beyond an aspirational goal in 2024. Energy efficiency became more important recently when Duke notified intervenors in November 2023 that the company needs to adjust its load forecast upward by approximately 4 GW between 2024 and 2030. Duke identifies the cause of the higher load forecast as the economic development coming to North Carolina. Based on this, Duke calls for more capital expenditure on large generation projects. But the first step before adding any new generation should be to ramp up energy efficiency measures to reduce the need.

New Technologies: Duke’s preferred portfolio places significant emphasis on small modular nuclear reactors (‘SMRs’) – also called “advanced nuclear” and hydrogen to provide low carbon generation, rather than prioritizing proven renewable energy sources like wind, solar, and storage. At this moment, the commercial viability of SMRs is still unclear. We’d have to see significant progress made soon with clear information on costs to rely on this technology as a major generation resource to reach carbon neutrality. Overall, although SMRs and hydrogen offer potential carbon reductions, they should not be relied upon too heavily given the considerable economic and market availability uncertainty.

Takeaways

All in all, the preferred plan proposed by Duke comes up short on offering near-term, least-cost solutions for ratepayers in the state, and doesn’t meet the legal requirements in HB 951 to reduce carbon emissions by 70% by 2030. Duke, an investor-owned utility company, leans towards large capital infrastructure investments, such as gas and nuclear that guarantee a long and dependable rate of return for their shareholders. It’s the job of the Commission to balance the financial interests of the utility with public interests like affordability, reliability, and carbon emissions reductions. For that reason, clean energy advocates, consumers, businesses, and other interested stakeholders will be weighing in with alternative modeling and recommendations for a path to decarbonization in line with the state-mandated goals established in HB 951.